Market Uncertainty to Impact Bitcoin (BTC) This Week

Bitcoin hovers around $30,000 as traders anticipate potential market shifts, amidst signs of Bitcoin accumulation and returning whales.

This week, Bitcoin (BTC) is trading above $30,000, but the absence of a definitive direction has the market anxious. Market participants are now awaiting signs of a significant trend change. This is largely because the leading cryptocurrency has been stuck in a phase of irregularity, bouncing back and forth between bear and bull markets without a clear sign of dominance.

This pattern has been persistent, despite various influencing factors such as macroeconomic data and institutional participation failing to alter the landscape. Hence, the scarcity of significant risk catalysts from the US or Federal Reserve in the upcoming week may not significantly impact Bitcoin’s trajectory.

Bitcoin’s Accumulation Phase and Market Sentiment

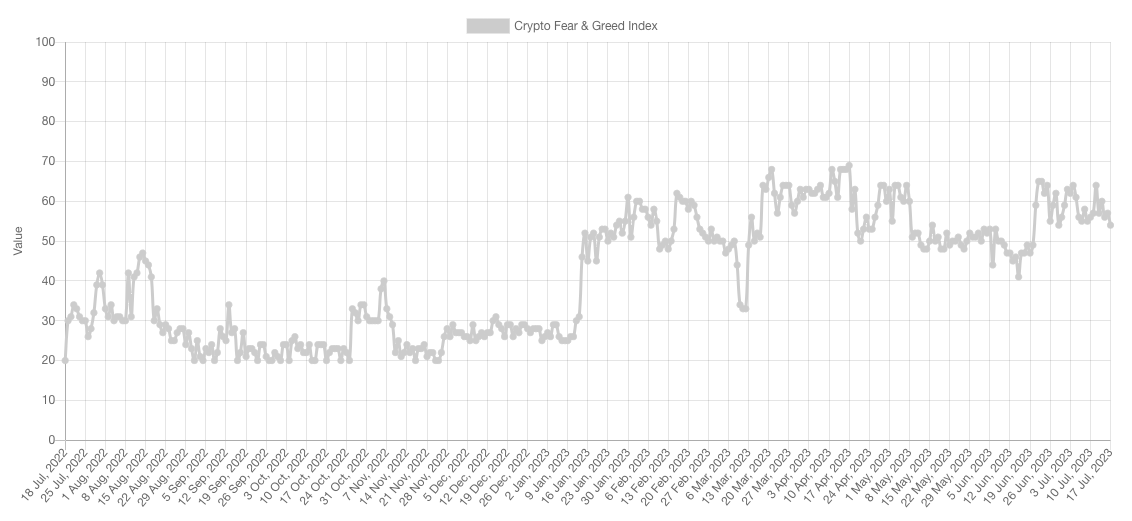

However, on-chain data suggests that Bitcoin is currently in a re-accumulation phase among its investor base, hinting towards a potential significant market move in the future. The Crypto Fear & Greed Index, a measure of crypto market sentiment, currently indicates a “neutral” state, but this metric is at its lowest point for July. Thus, traders and investors are gearing up for potential BTC price triggers this week, closely monitoring a variety of elements.

Bitcoin’s weekly close demonstrated a distinct lack of volatility, offering a welcome respite from erratic short-term price movements. Support at the critical $30,000 level remained unscathed, allowing BTC to continue within a small trading range established last week. This comes after an upward swing towards a new yearly high was followed by a swift pullback. Observers now anticipate that Bitcoin might be gearing up for another local low due to the failure of bulls to break the range for a considerable duration. Some even suggest a return to a level around $27,400, which hasn’t been seen for nearly a month.

Bitcoin and U.S. Data Releases

This week, US data releases are unlikely to cause significant fluctuations in risk assets, which might be disappointing for those looking for a macroeconomic shake-up. The key event to watch is the tech firm earnings and jobless claims data set on which officials will release on July 20.

Nevertheless, a decision on interest rate hikes by the Fed is still approximately two weeks away, keeping volatility in sight. Current predictions suggest a near-unanimous belief in a 0.25% rate hike, irrespective of data showing faster than expected inflation retreat.

The US Dollar Index (DXY), currently attempting to regain the 100 mark, is another critical metric to watch given Bitcoin’s historical inverse correlation with it.

Bitcoin Whales Making a Comeback

On-chain data analysis by CryptoQuant indicates a resurgence of Bitcoin whales, or large-scale Bitcoin holders. The metric of unspent transaction outputs (UTXOs), which represent large amounts of untouched Bitcoins, is increasing — a trend typically associated with a bull market.

This increase suggests that whales are gradually returning to the market after a quick withdrawal in late 2022, possibly signalling that Bitcoin’s price at the end of 2022 could be a long-term bottom, with an upward trend to follow.

Bitcoin Supply Dynamics Hint Bullish Signs

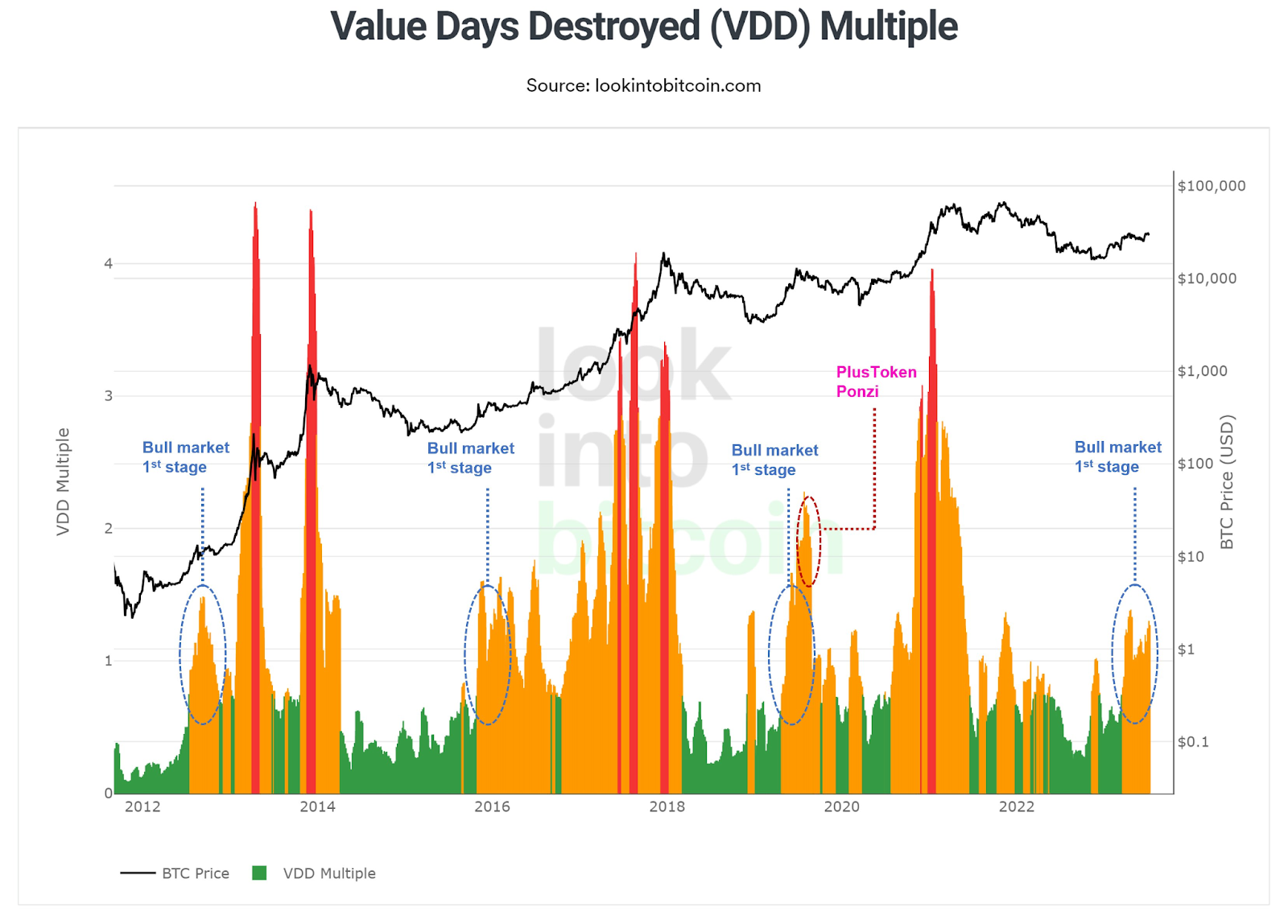

It’s not just the behaviour of Bitcoin whales that has analysts’ attention when it comes to potential bullish signs for BTC. Latest on-chain data shows that the BTC supply movement has been most significant near the $30,000 mark, reflecting a keen interest in this price point among the investor base.

Furthermore, older Bitcoin supply that has been dormant for a long time is beginning to see action. This is a characteristic that has historically been associated with the initial stages of Bitcoin bull markets.

Fluctuating Market Sentiment in Crypto Space

The Crypto Fear & Greed Index, a popular measure of market sentiment, illustrates the volatile nature of crypto investors. While it’s currently in the “neutral” range, it is at its lowest point for July, suggesting a more cautious sentiment around the $30,000 threshold.

Notably, extreme values of this index often indicate upcoming market rebounds or retracements. As a result, traders and investors keep a close watch on this index to gauge the overall mood and sentiment of the market and to predict potential future trends.

Comments are closed.