Stablecoin Loans of Tether (USDT) Increased in 2023

Despite 2022’s downsizing announcement, stablecoin loans of Tether (USDT) increased in 2023 due to requests from long-standing partners.

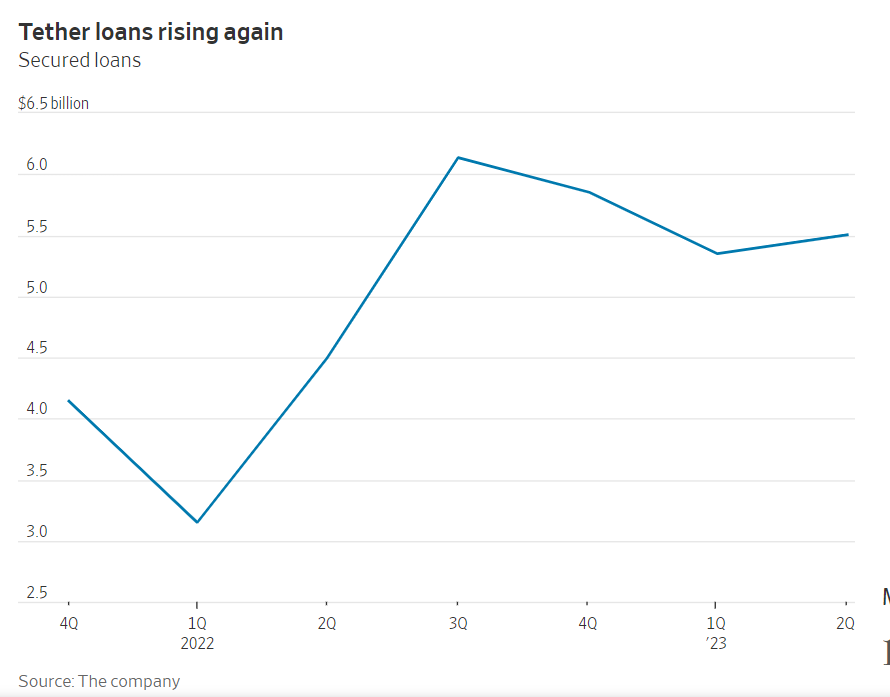

Despite making a declaration in December 2022 about reducing its stablecoin loans, Tether, the crypto world’s leading stablecoin issuer, has reported an increase in 2023. The first six months ended with Tether’s assets boasting $5.5 billion in loans. This marks an increase from the previous quarter’s $5.3 billion.

Some industry insiders might find this rise surprising. Especially when taking into account Tether’s previous commitment to downsizing its loan offerings. Delving deeper into the reasons, long-term partners of Tether approached the firm for some short-term loans. These aren’t just any partners but are those with whom Tether has nurtured and maintained deep ties over the years. Furthermore, while the increase in lending goes against last year’s commitment, Tether assures the crypto community of its plan to wind down such loans by 2024.

Controversies Surrounding Tether’s Secured Loans

Stablecoin lending emerged as a sought-after product for Tether. In this arrangement, customers received the opportunity to borrow USDT (Tether’s stablecoin) against collateral. However, clouds of doubts and controversies loomed over these loans. The primary concern? A potential lack of clarity about the borrowers and the nature of the collateral backing the loans.

A report from The Wall Street Journal (WSJ) in December 2022 escalated these concerns. It flagged potential issues with the loans not being fully collateralized. There were fears about Tether’s capacity to fulfill redemption needs during financial crunch periods. To this end, Tether took a stand in 2022. They branded these speculations as mere “FUD” (Fear, Uncertainty, Doubt). Moreover, the firm asserted that these loans had collateral worth more than their value.

This year’s uptick in Tether’s secured lending coincides with its growing dominance in the market. The firm recently revealed its surplus reserves to be a whopping $3.3 billion in September. This is a significant jump from 2022’s $250 million. While Tether didn’t provide a direct comment to Cointelegraph’s queries, they did address the WSJ’s article. They downplayed the concerns around their stablecoin loans. Tether highlighted their substantial equity and projected yearly profit of $4 billion. The company believes that these profits, which they plan to keep within their balance sheet, effectively counterbalance the secured loans. Despite this defense, Tether remains committed to its original plan of phasing out the loans from its reserves.

Comments are closed.