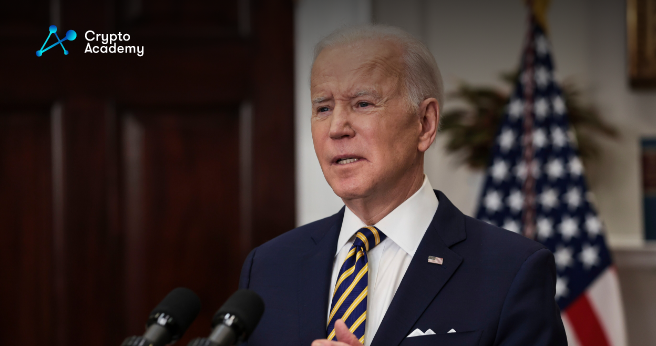

President Joe Biden To Eliminate Loopholes For Crypto

President Joe Biden of the United States has declared his intent to eradicate tax escape routes for cryptocurrency traders and hedge fund executives. As part of his fairness initiative for the federal tax system, Biden expressed a commitment to promote the sharing of tax burdens by affluent individuals and sizable corporations while assuring the middle class would not face tax increases.

US President Targets Tax Loopholes for Cryptocurrency Investors

During an economic policy discourse in Chicago, aptly termed “Bidenomics,” the President touched on the issue of taxes applied to cryptocurrency traders. He began with a question to his audience: “Does anyone here think the federal tax system is fair? Raise your hand.” His subsequent comments made his intentions clear: eradicate the concessions for cryptocurrency investors and hedge fund managers to enhance tax fairness.

In his quest to bring about tax equity, Biden stated:

“(The aim is) to get billionaires to contribute a little bit more, at least a minimum tax. No billionaire should be subjected to a lower tax rate than a schoolteacher, a firefighter, or a cop.”

He expressed his dedication to making the tax code impartial to everyone, compelling the rich, super-rich, and corporate entities to shoulder their fair share of taxes. However, he reaffirmed his stand on preventing any tax hike on the middle class.

Reactions to Biden’s Tax Reforms

Biden’s discourse instigated numerous reactions from cryptocurrency enthusiasts and experts on social media. Gabor Gurbacs, an advisor at the investment management firm Vaneck, tweeted in response to Biden’s speech. He pointed out that the U.S. had accumulated $9 trillion in debt over the last three years. Moving on, Gurbacs criticized the government’s spending habits, saying it was more of an expenditure issue than a revenue problem. He further expressed his confusion over Biden’s comments on abolishing tax loopholes for cryptocurrency traders, claiming that there are hardly any.

Another prominent figure in the cryptocurrency world, Ryan Selkis, the founder and CEO of the crypto analytics firm Messari, also provided his thoughts. He said that President Biden, at 80 years old, is among the few in Washington who might have gone through the 70,000-page tax code. Selkis, however, suggested that the president seemed perplexed. According to him, there are no “crypto trader” tax loopholes. He also criticized Biden’s policies for negatively affecting capital gains.

Other Presidential Candidates and Their Crypto Stances

The proposed cryptocurrency tax amendments don’t exist in a vacuum, as future presidential candidates are also presenting their positions on the subject. For instance, Florida Governor Ron DeSantis, a potential candidate for the 2024 Presidential race, has pledged to abolish the Internal Revenue Service (IRS) if he’s elected.

This bold move suggests a drastic shift in the tax landscape, potentially impacting how cryptocurrency gains are taxed. DeSantis’s stance could translate to more lenient crypto regulations, a significant contrast to the current administration’s direction. This broad spectrum of political positions paints a multifaceted picture of the potential future of cryptocurrency regulations in the U.S.

European Stance on Cryptocurrency Taxation

While the U.S. is navigating its approach towards cryptocurrency tax regulation, one can’t help but wonder about the course other nations, particularly European countries, might take. Would they mirror the strategy of President Biden, seeking to enforce a similar tax regime for crypto investments?

Adopting the U.S. approach might mean the end of loopholes for crypto traders, prompting them to contribute more to the tax revenues. However, it would also imply stringent regulations that could potentially hinder the growth of the cryptocurrency market. Therefore, these countries would have to strike a balance between promoting a robust crypto market and ensuring fairness in their tax system. Each country’s approach will largely depend on its economic landscape, regulatory framework, and overall stance on cryptocurrency.

Comments are closed.