Bitcoin Ordinals Surge Amid Binance Integration

Bitcoin Ordinals trading surges after Binance lists ORDI, leading to a peak in transaction volumes and token value.

The Bitcoin Ordinals market witnessed a notable uptick in activity with Binance integrating ORDI, the premier BRC-20 token, leading to a significant boost in trading volumes. The transaction volume of Bitcoin-based assets soared, reaching a six-month high on Tuesday, with around $14.7 million worth of trades. On-chain data analyst known by the pseudonym Domo via a Dune dashboard shared this data first.

Ordinals, which debuted earlier in the year, bring a unique feature to the Bitcoin ecosystem, allowing for the creation of non-fungible token (NFT)-like assets on the Bitcoin blockchain itself. This occurs by embedding data onto individual satoshis, the smallest Bitcoin unit, turning them into digital artifacts such as artwork, avatars, or even simple text.

The surge in volume was predominantly observed on the OKX platform, a Seychelles-based cryptocurrency exchange. Since May, OKX has supported Ordinals trading and, as per Domo’s data, was responsible for 60% of the daily transactions, amounting to 6,100 Ordinals transfers.

Trading Activity Spikes with ORDI Token Demand

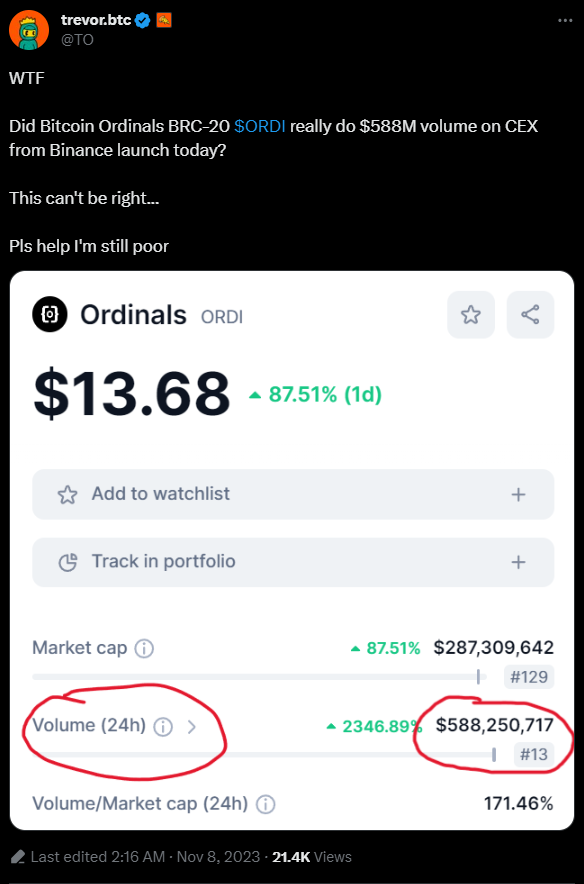

Binance, the leading cryptocurrency exchange by trading volume, initially backed image-based Ordinals in May. It further expanded its offerings by allowing trading of ORDI on Tuesday. This inclusion resulted in a remarkable price surge of 124% for the ORDI token, elevating its price to $13.21 from the original listing price of $5.91 on Binance. Across various exchanges, ORDI’s 24-hour trading volume hit $471 million, as reported by CoinGecko.

This increase in Ordinals trading has coincided with Bitcoin’s price movement towards the $35,000 mark. Charlie Spears from Luxor Technologies attributes the spike to Binance’s backing of ORDI, which he believes has significantly influenced the related markets, covering both fungible tokens and NFTs.

BRC-20 tokens, akin to Ethereum’s ERC-20 standard, were first brought into existence by Domo as an experimental token named ORDI. Despite being a fresh entrant in March, its association with Binance has thrust it into the limelight, although it is not formally linked with the Ordinals project as clarified by Ordinals inventor Casey Rodarmor.

The increased interest in Bitcoin NFTs also reflects in the broader NFT market’s resurgence. Despite some skepticism earlier in the year when Bitcoin transaction fees surged due to heightened Ordinals activity, the current rate for high-priority transactions has settled at more affordable levels.

Yuga Labs, the creators behind the well-known Bored Ape Yacht Club, has also capitalized on the Ordinals platform for their Bitcoin-based artwork. The general sentiment suggests that Binance’s recent move could potentially reignite the interest in BRC-20s and, by extension, impact the wider Bitcoin NFT ecosystem positively.

The integration of ORDI on Binance and the resultant trading fervor underscores the growing intersection of traditional cryptocurrencies like Bitcoin with the evolving NFT space, a trend that seems set to continue shaping the digital asset landscape.

Comments are closed.