Do Kwon’s Defense Responds to SEC Probe on Jump Trading

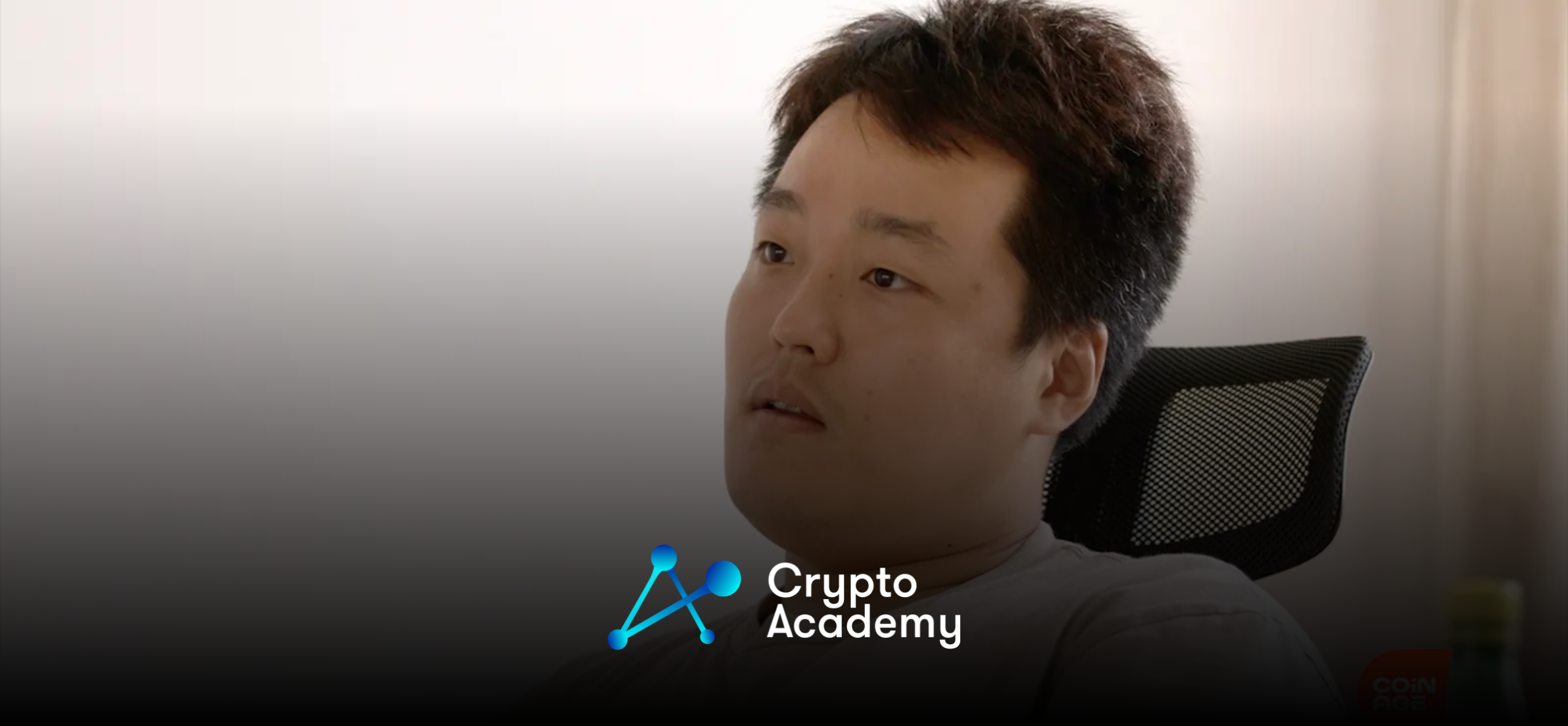

In the ongoing legal battle surrounding Terraform Labs and its co-founder Do Kwon, fresh evidence has emerged shedding light on the role of Jump Trading in the collapse of the TerraUSD (UST) stablecoin. This development comes as the defense team for Terraform Labs and Do Kwon submitted crucial information to the Supreme Court of Singapore. The court had requested this data in response to allegations by the US Securities and Exchange Commission (SEC) regarding misrepresentation of UST’s stability.

The SEC had accused Terraform Labs of falsely representing the capabilities of its algorithm in maintaining UST’s peg in 2021. The Commission further alleged that the 2021 depeg of UST was, in fact, orchestrated by Jump Trading, a prominent US market maker. Notably, Jump Trading was conspicuously absent when UST experienced a subsequent collapse in 2022.

Insight from Exchange Data

Defense lawyers presented compelling evidence, citing May 2021 as the period when UST’s depeg occurred due to a surge in traders withdrawing USDT from KuCoin, directing them toward both decentralized (DEX) and centralized exchanges (CEX). Data from KuCoin, the initial exchange to list UST, clearly demonstrated heightened selling activity on the day of the depeg.

According to SEC expert Dr. Bruce Mizrach, Jump Trading appears to have played a significant role in making purchases that contributed to the recovery of UST’s price back to $1. The defense team confirmed that Jump Crypto engaged in trading activities on that day and provided wallet addresses for Jump and its affiliated entities, offering valuable insights into their trading strategy.

2022 Depeg: A Deja Vu?

The situation in May 2022 echoed the events of 2021, as UST withdrawals on KuCoin surged just before UST’s value dipped below $1. Similar to 2021, data from KuCoin pointed to Jump’s trading activities, though the extent of their involvement remains unclear. Further investigation into the addresses linked with Jump will be crucial in determining their role in UST’s re-peg in 2021.

If it is established that Jump had a diminished role in purchasing UST in 2022, it could potentially bolster the SEC’s argument that Terraform’s algorithm to maintain UST’s value at $1 was fundamentally flawed.

Implications for Crypto Regulations

The TerraUSD case, along with others like it, has highlighted the evolving and complex nature of regulations within the crypto industry. In 2021, crypto companies blurred the lines between brokerage, market-making, and settlement activities, causing concern among regulators. Instances like the FTX Trading and Alameda Research collapse underscore the risks posed by intertwined business models, affecting not only the companies involved but also the broader crypto ecosystem.

As regulators intensify their efforts to crack down on non-compliant practices, the crypto industry is facing a pivotal moment. It remains to be seen how these developments will influence the industry’s future and how companies will navigate the evolving regulatory landscape.

In conclusion, the defense’s submission of new evidence in the TerraUSD case brings us one step closer to understanding the intricate dynamics of the crypto market and its relationship with regulators. This ongoing legal battle could have far-reaching implications for the industry as it grapples with the need for tighter oversight.

Comments are closed.