Is Rising GBTC Fees Diminishing its Appeal?

The cryptocurrency landscape is continually evolving, and recent developments within Grayscale Bitcoin Trust (GBTC) are a testament to this. In a notable shift, GBTC’s Bitcoin reserves have seen a significant reduction.

As of January 16, there was a noticeable decrease of around 12,000 Bitcoins (BTC) from their holdings, bringing the total down to 587,532.60 BTC from the 599,532.60 BTC recorded on January 11. This change, amounting to approximately $511.2 million based on current Bitcoin market values, raises questions about investor behavior and preferences, particularly in relation to GBTC.

GBTC has long been a gateway for institutional investors to gain exposure to Bitcoin. However, with the advent of spot Bitcoin exchange-traded funds (ETFs), these investors now have access to more cost-effective alternatives.

This shift is particularly relevant when considering the fee structure of GBTC, which stands at a high 1.5%. This rate is notably higher than that of competitors such as BlackRock’s iShares Bitcoin Trust, which offers a fee of up to 0.25%. The lower fees of these alternative ETFs might be influencing investors to reconsider their investment choices.

Navigating Fees and Liquidity in the Bitcoin Investment Space

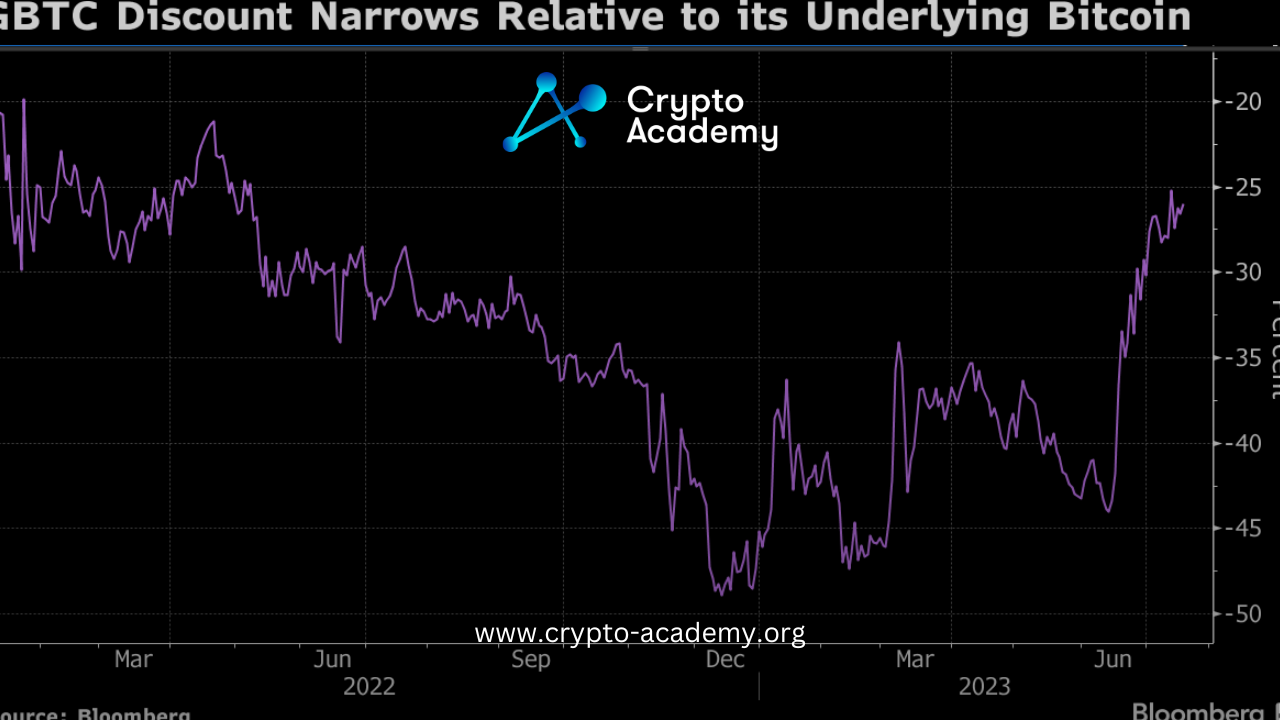

The fee disparity is not the only factor influencing investor decisions. Recently, the discount to net asset value (NAV) for GBTC shares has significantly narrowed, from around 47% in February 2023 to just 1.18%. This reduction in the discount rate might encourage investors to redeem their shares and secure profits.

Despite these factors, GBTC continues to hold an advantage in terms of liquidity. This higher liquidity level in GBTC trading minimizes slippage, thereby making trading activities more cost-effective. For active traders who frequently buy and sell GBTC shares, the higher fee might be less impactful compared to the costs associated with entering or exiting trades in less liquid instruments.

Comments are closed.