Binance Ends Support for Selected Leveraged Tokens

Binance to end support for certain leveraged tokens, urging users to convert or redeem by set deadlines.

Affecting cryptocurrency traders globally, Binance, a leading crypto exchange, has announced its intention to discontinue several leveraged token offerings. This decision impacts tokens associated with major cryptocurrencies like Bitcoin, Ether, and BNB. Specifically, the services ending involve tokens paired with Tether (USDT), including BTCUP, BTCDOWN, ETHUP, ETHDOWN, BNBUP, and BNBDOWN.

Important Dates and Actions for Users

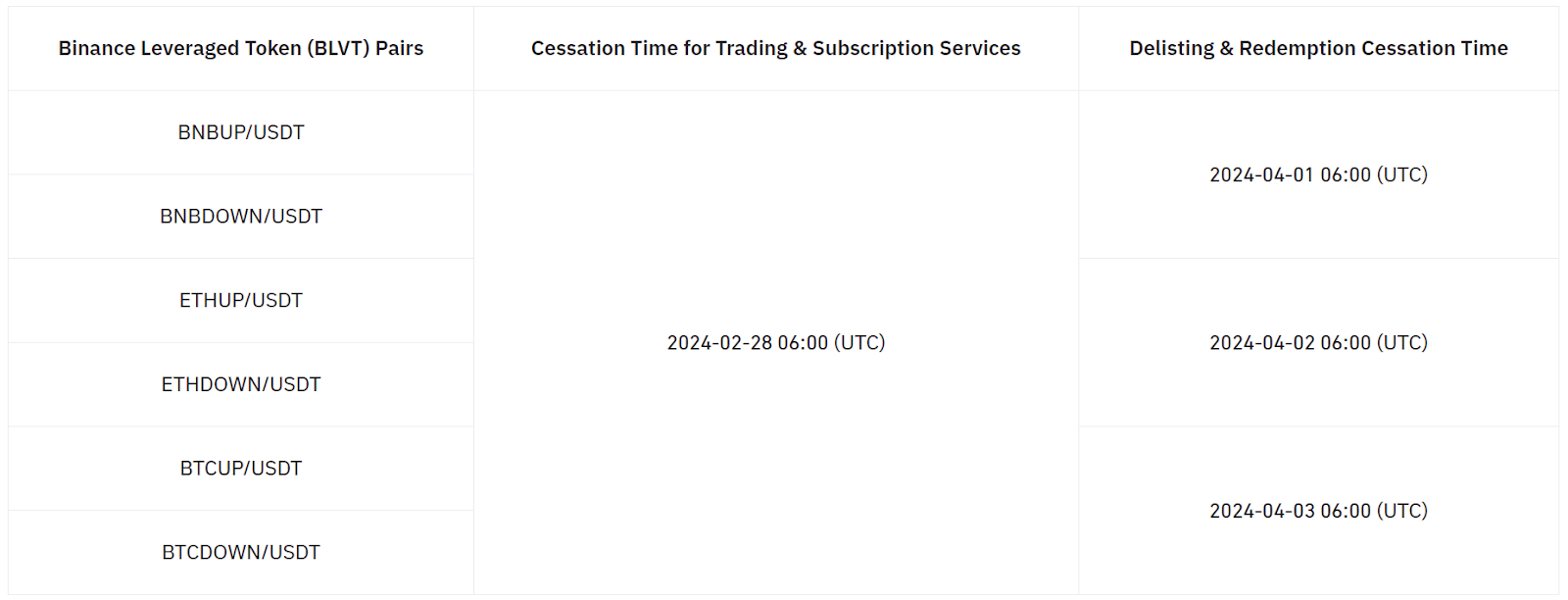

Binance has set a schedule for the phase-out of these leveraged tokens. Trading and subscription services for the affected tokens will halt on February 28 at 06:00 UTC. From this point, Binance will automatically cancel all existing trade orders related to these tokens. Users are encouraged to convert their holdings into other cryptocurrencies before the deadline to avoid potential losses.

The process of delisting and halting the redemption of these tokens will commence on April 1, concluding by April 3. Binance emphasizes the importance of redeeming tokens before delisting to ensure users can manage their investments proactively. Those who miss the redemption period will see their tokens converted into USDT at their value on the delisting date, with the exchange crediting the equivalent amount to user accounts within 24 hours post-conversion.

Leveraged Tokens on Binance

Leveraged tokens on Binance offer investors an opportunity to gain leveraged exposure to cryptocurrencies without the need for collateral. These tokens, representing a collection of perpetual contract positions, respond to market movements in the perpetual contracts market. While they offer the advantage of leveraged positions without the necessity for maintenance margins or the risk of liquidation, Binance cautions users about the inherent risks. These include the volatility in the perpetual contracts market, potential premiums, and fluctuating funding rates.

Binance’s decision to phase out certain leveraged tokens underlines the importance of understanding the risks associated with leveraged trading. While these instruments can amplify returns, they also increase the potential for losses, especially in the volatile cryptocurrency market. Binance advises its users to carefully consider their trading strategies and the risks involved in leveraged tokens.

For traders holding the affected leveraged tokens, now is the time to review your portfolio and make necessary adjustments.

Comments are closed.