Crypto Inflows Continue: Europe Leads, U.S. Market Eyes Growth

Crypto investments surge, with Europe leading inflows and CoinShares highlighting U.S. market potential.

The cryptocurrency market is buzzing with activity. Recent reports indicate that the past week witnessed the largest inflows into crypto investment products since July 2023. CoinShares, a renowned crypto asset management firm, shed light on this trend in their latest weekly analysis.

In the last week alone, crypto investment products amassed inflows worth $78 million, marking the second straight week of consistent inflows. This shift in investor interest aligns with a broader uptick in the crypto market. Exchange-traded products (ETPs) linked to cryptocurrencies saw their volumes soar by a staggering 37%, reaching the $1.1 billion benchmark. Bitcoin wasn’t left behind either; its volumes on trustworthy exchanges witnessed a solid 16% growth.

Altcoins Shine Bright

Solana, currently seated as the eighth-largest cryptocurrency in terms of market capitalization, is emerging as a top contender in the altcoin space. The cryptocurrency has experienced a remarkable rise in weekly inflows, hitting its highest since March 2022. As per data collated from CoinGecko, Solana has seen a 14% uptick over the previous month. However, when viewed through a yearly timeframe, it’s still trailing by approximately 32%.

Read More: Impressive Inflows for Solana in 2023

While the crypto market sees this general upward trend, not all segments share the same story. The United States Ethereum futures exchange-traded funds (ETFs) began trading just a week ago, on October 2nd. Their performance paints a slightly subdued picture, raking in just about $10 million in the opening week. CoinShares describes this response from investors as a “mild appetite”.

Geographical Investment Patterns in Crypto

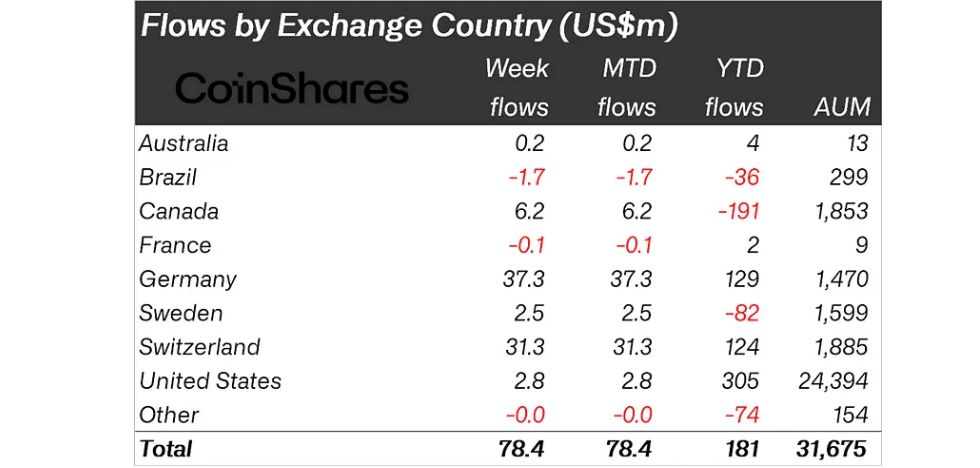

Europe is at the forefront when it comes to crypto asset inflows, contributing a massive 90% of the total. On the flip side, both the U.S. and Canada combined managed to secure a piece of the pie worth just $9 million. A deeper dive into the numbers reveals that Germany and Switzerland are leading the charge. Together, these two European nations were responsible for a whopping 88% of all crypto asset product inflows over the past week.

CoinShares isn’t just a passive observer of these trends. They’ve been proactive, recently launching their first range of offerings in the U.S. in September 2023. They hold a firm belief in the U.S.’s potential to pioneer the future of digital asset development and regulation.

Comments are closed.