Dissecting the Differences Between Coinbase & Binance SEC Lawsuits

The SEC targets Binance and Coinbase, while allegations emerge of Gensler offering advisory services to Binance in 2019.

In recent events, the U.S. Securities and Exchange Commission (SEC) has targeted two significant crypto brands – Binance and Coinbase – with lawsuits. These legal actions have set off alarm bells across the global cryptocurrency industry. With stark differences in the nature of the allegations, both cases have raised serious questions about the future of crypto regulation.

SEC versus Binance

Binance, the world’s leading digital asset exchange by volume, found itself in the SEC’s crosshairs with accusations of financial misconduct. SEC Chairman Gary Gensler characterized the operations of Binance as a “web of deception” and alleged that the company, under the leadership of CEO Changpeng Zhao, had misused customer funds.

These claims against Binance bear similarities to accusations lodged against its former competitor, FTX. But unlike FTX’s Sam Bankman-Fried, who faces 13 criminal charges, no criminal charges have been laid against Binance or Zhao at this time.

The allegations suggest that Binance utilized customers’ fiat and crypto assets at their discretion. Federica Pantana, a securities law compliance expert, has expressed concerns over the long-term impact of these allegations on Binance, as it may struggle to recover its reputation following such damaging claims.

The SEC’s Charges Against Binance

Earlier this week, the SEC leveled 13 charges against Binance and Zhao. The allegations include failure to register as an exchange and broker-dealer, improper commingling of funds, and a lack of critical internal controls over business operations.

However, the lawyers for Binance argue that before these charges, Gensler had attempted to establish close relations with the company. This account matches previous reports by The Wall Street Journal, which cited internal Binance communications and a source close to the SEC Chair, both suggesting that Binance had approached Gensler.

Allegations of Gensler’s Prior Ties to Binance

In a dramatic turn of events, the legal counsel for Binance and its founder, Changpeng Zhao, has asserted that Gary Gensler, current Chairman of the U.S. Securities and Exchange Commission (SEC), offered his advisory services to Binance’s parent company back in 2019. This claim comes amid the SEC’s rigorous crackdown on cryptocurrency companies, which has sparked intense controversy in the crypto industry.

Gensler’s Supposed Courtship of Binance

According to the attorneys from Gibson Dunn and Latham & Watkins, Gensler proposed to act as an advisor to Binance during several discussions with its executives and Zhao in March 2019. He even reportedly met Zhao for lunch in Japan later that month. At that time, Gensler was a faculty member at the Massachusetts Institute of Technology’s Sloan School of Management. He was later appointed as the SEC’s Chair in 2021 by President Biden.

Since his appointment, Gensler has embarked on a rigorous campaign against the crypto industry, with the SEC issuing lawsuits against multiple companies for allegedly dealing in unregistered securities.

Gensler’s Continued Interactions with Zhao

Binance’s legal counsel claims that Zhao maintained contact with Gensler after their March meeting. They further assert that Gensler requested an interview with Zhao for a cryptocurrency course he was teaching at MIT.

Zhao’s lawyers now argue that their client understood Gensler to be “comfortable serving as an informal advisor.” Later in 2019, Gensler was due to testify before the House Financial Services Committee, and he allegedly shared a copy of his planned testimony with Zhao ahead of the hearing.

Call for Gensler’s Recusal

Given Gensler’s purported ties to Zhao, Binance’s lawyers have requested his recusal from any actions involving the company. However, they claim to have received no acknowledgment from SEC staff.

In response to these allegations, an SEC spokesperson stated that “the Chair is very familiar with and in full compliance with his ethical obligations including any recusal obligations.”

The SEC’s investigations into Binance.US and Binance commenced in 2020 and 2021, respectively, long after the alleged last contact between Gensler and Zhao.

Allegations Against Coinbase

Unlike Binance, the SEC has taken a different angle with Coinbase. The SEC accuses Coinbase of operating as an unregistered national securities exchange, broker, and clearing agency for years. There’s an added layer of complexity here: Coinbase allegedly sold unregistered securities through its staking service.

While the SEC also accuses Coinbase of commingling, it refers to the mingling of business functions, not funds. In traditional securities markets, the roles of securities exchange, broker, and clearing agency are separate. The SEC alleges Coinbase combined these functions without proper registration, violating securities laws.

Bradley Perry, a former CFTC trial attorney, has pointed out that the SEC’s lawsuit against Coinbase doesn’t involve any claims of fraudulent activity. Interestingly, he also notes that the SEC seemed to give a nod to this business model during its IPO diligence.

Role of Binance and Coinbase CEOs in the Lawsuits

In the Binance lawsuit, the SEC has taken direct aim at CEO Changpeng Zhao. The 136-page complaint mentions Zhao nearly 200 times and heavily implies that the alleged misconduct occurred under his control.

On the other hand, the SEC’s lawsuit against Coinbase only mentions CEO Brian Armstrong once. This discrepancy in how the SEC treats the CEOs of the two companies provides a telling insight into the nature and severity of the allegations.

In the case of Binance, the SEC alleges that billions of customer funds ended up in an account controlled by Zhao. The funds were then supposedly transferred to a third party for crypto asset trading. This allegation, if proven, could significantly tarnish Binance’s image and further impact Zhao’s reputation in the crypto industry.

Alleged Violations of Securities Laws

An intriguing aspect of the SEC’s allegations is its claim that Binance allowed American customers to trade on its platform, a direct violation of securities laws. Binance has always maintained that its primary platform is off-limits to US customers, who are instead served by Binance.US, a separate entity.

The case against Coinbase doesn’t include any allegations of unlawfully offering services to restricted customers. However, the SEC seeks a penalty that could ban Coinbase from operating as an exchange or broker in the U.S., a significant blow to its operations.

Reactions from the Crypto Industry

The lawsuits have sparked a flurry of reactions from industry insiders. Kristin Smith, the CEO of the Blockchain Association, labeled the SEC’s approach to regulation as unacceptable. Others in the sector, such as Paolo Ardoino, CTO of Tether, and Ted Shao, CEO of Turbos Finance, echoed this sentiment.

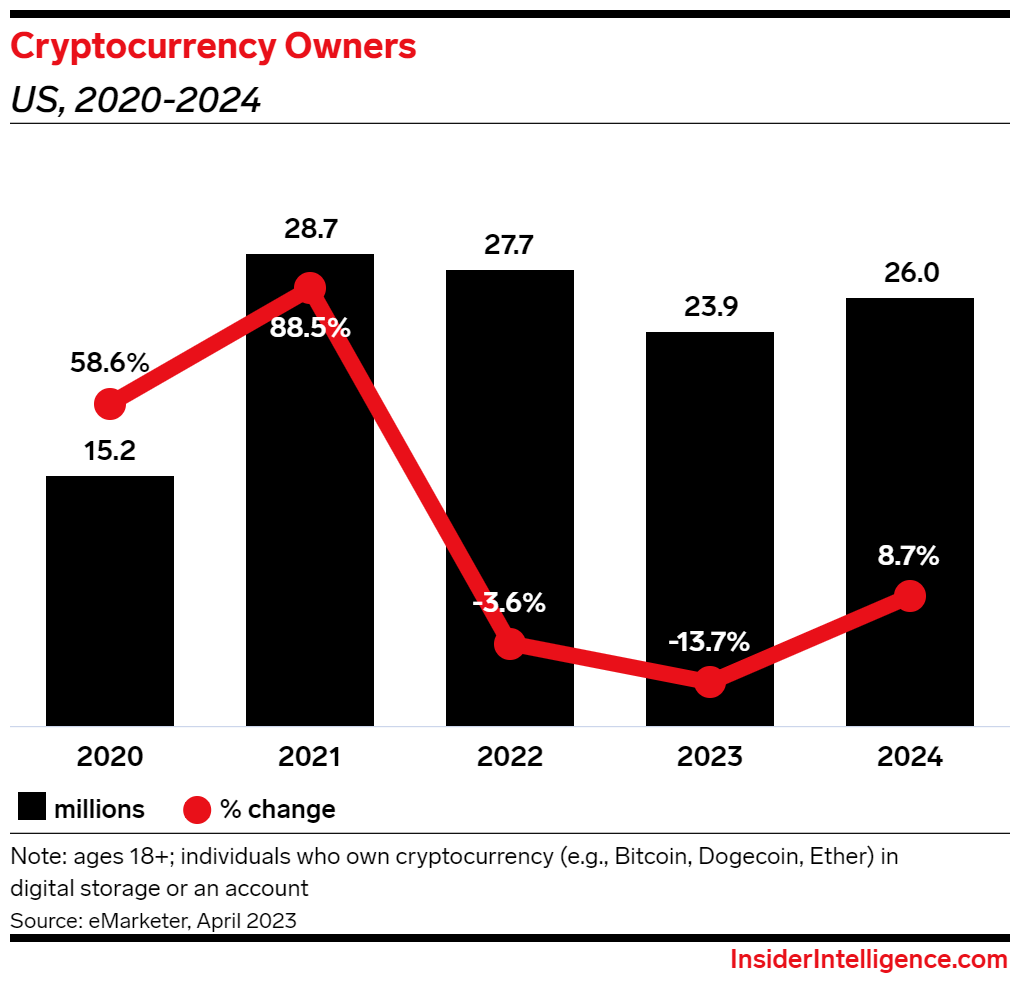

Many feel that the SEC’s aggressive stance could have far-reaching implications. It could drive crypto players to more crypto-friendly jurisdictions, harming the industry’s growth in the United States. Additionally, these actions could further undermine the already fragile consumer confidence in cryptocurrencies in the country.

SEC’s Approach to Regulation

The lawsuits against Binance and Coinbase have raised doubts about the SEC’s intentions and methods. David Schwed, COO of Halborn, and Alex Strześniewski, founder of AngelBlock, criticized the SEC for its heavy-handed and opaque approach to regulation. The lawsuits, they argue, are a poor substitute for clear and coherent regulation.

Impact on the Crypto Market

The SEC’s lawsuits could also impact the cryptocurrency market, according to Stephan Lutz, CEO of BitMEX. Lutz predicts short-term downward pressure on the prices of crypto stocks, altcoins, and valuations of U.S.-based crypto startups. He believes that investors may shift towards Bitcoin or stablecoins, which have a stronger correlation with fiat and are less likely to be considered securities.

In the longer term, exchanges may exercise more caution when dealing with U.S. customers and offering access to potential securities, further reflecting the chilling effect of the SEC’s regulatory actions.

The SEC’s lawsuits against Binance and Coinbase have sent shockwaves through the crypto industry. These cases underscore the pressing need for clear, coherent, and fair regulation of the crypto space. As the lawsuits unfold, the industry will be watching closely, with the outcome potentially shaping the future of crypto regulation.

Comments are closed.