SEC Ethereum ETFs Approval Sparks Polymarket Controversy

The SEC’s approval of rule changes for Ethereum ETFs sparked a contentious debate on Polymarket over bet interpretations.

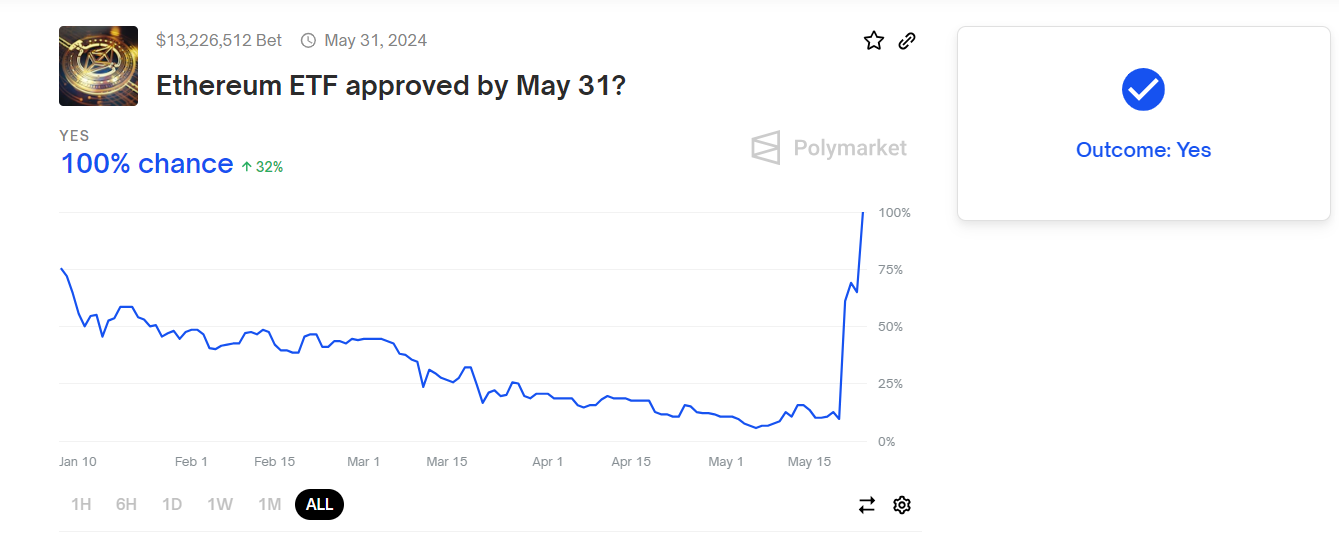

The U.S. Securities and Exchange Commission (SEC) recently announced the approval of eight spot Ethereum ETFs, igniting a heated debate over what “approved” actually means. Crypto enthusiasts on Polymarket, a prediction market platform, wagered over $13 million on the SEC’s approval of spot Ethereum ETFs by May 31, leading to a contentious discussion on whether the approval indeed took place.

This open wager, which went live on January 9, came from the anticipation surrounding the SEC’s decision on the first Bitcoin ETFs. The core issue was whether Ethereum would be classified as a security or a commodity, a decision heavily influenced by Bitcoin’s regulatory treatment.

Analysts’ Predictions and SEC’s Moves

As the potential Ethereum ETF approval date approached, financial analysts and crypto commentators shared increasingly pessimistic predictions, partly due to the SEC’s aggressive actions against other crypto projects. Some speculated that a delay could actually be beneficial. For instance, JP Morgan estimated a 50% chance of approval last month.

However, sentiment shifted last week. Coinbase predicted an imminent approval of an Ethereum ETF, and two Bloomberg analysts revised their approval odds from 25% to 75%. This optimism caused Ethereum’s price to surge.

On Polymarket, bettors closely monitored these developments. The odds of SEC approval on the platform jumped from 13% to over 50% on Monday. When the SEC announced on Thursday that it was approving applications for spot Ethereum ETFs, many wagerers celebrated, believing the confirmation of the bet’s outcome.

Defining “Approval”: The Crux of the Dispute

Despite the initial celebration, a significant number of participants argued that the terms of the bet were ambiguous. The SEC had approved rule changes allowing major investment firms like Grayscale, BlackRock, Fidelity, and VanEck to proceed with their plans to offer spot Ethereum ETFs. However, these specific funds had not yet received final approval, a process that could extend beyond the May 31 deadline set by Polymarket.

This ambiguity led to accusations of the bet being “rigged,” with nearly 1,000 comments posted on the event page. Some users suggested a 50/50 split of the wager, arguing that the rules were not clear enough to determine a definitive winner.

Polymarket’s Resolution and Market Reactions

The wording of the SEC’s decision was scrutinized, with some participants asserting that it clearly indicated approval: “This order approves the proposals on an accelerated basis.” Despite the debate, Polymarket allowed users to dispute the outcome of the bet. By 8:18 p.m. ET, the yes vote had been confirmed.

For many, the straightforward interpretation of the SEC’s announcement was sufficient. Investors in Polymarket, including prominent figures, emphasized the importance of resolving the bet of ETFs approval according to the spirit of the market to maintain trust.

As the dust settled, the broader crypto market continued to operate as usual. Ethereum’s price remained relatively stable despite the approval news, although it had increased by nearly 30% over the week, peaking at $3,937 and trading at $3,819 at the time of writing.

Polymarket, launched in 2020, is a blockchain-based prediction market platform where users stake tokens on the outcomes of various events, including elections, sports, and current affairs. Earlier this month, Polymarket raised $70 million from investors, including Ethereum co-founder Vitalik Buterin.

Lastly, this platform’s role in facilitating large-scale wagers and its impact on the crypto community highlight the evolving nature of decentralized finance and prediction markets. As these markets grow, the importance of clear rules and transparent resolutions becomes increasingly evident.

Comments are closed.