Bitcoin Fees Spike: Miners Gain, Layer-2 Solutions Rise

Bitcoin transaction fees soar, driving miners’ profits and spotlighting the need for layer-2 solutions.

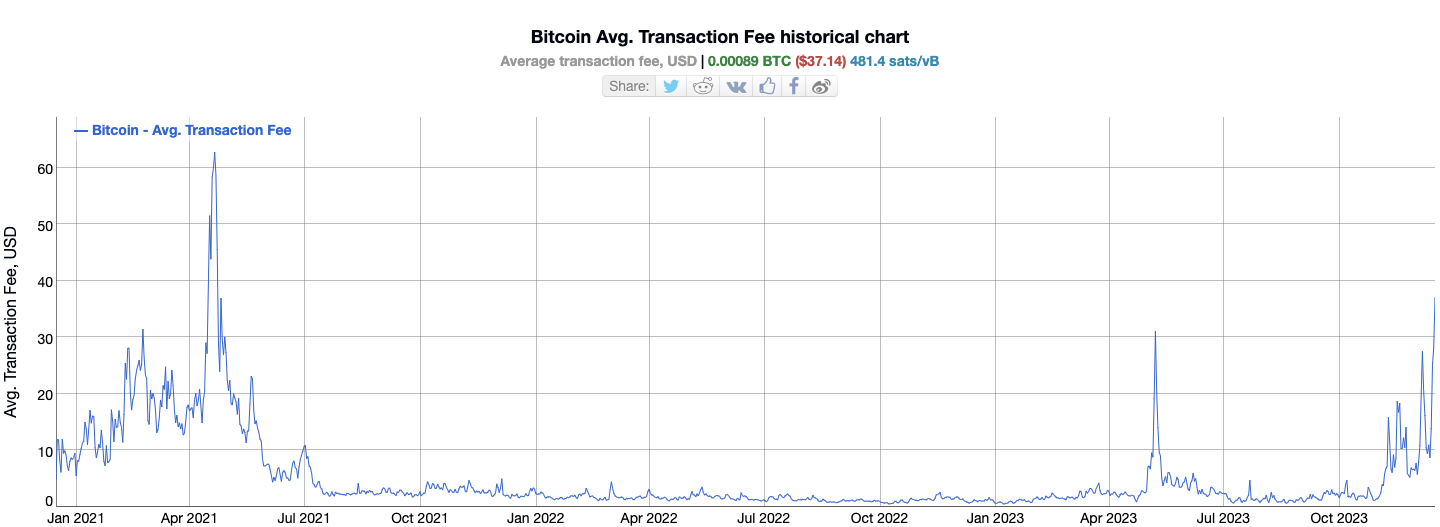

Bitcoin has witnessed a significant surge in transaction fees, reaching a 20-month peak. This trend has particularly favored Bitcoin miners, with their revenues mirroring the heights seen when Bitcoin soared to $69,000. Currently, the average cost of a Bitcoin transaction hovers around $40, a rate not observed since April 2021.

Impact of High Fees on Bitcoin Transactions

These escalating fees are primarily driven by the influx of Bitcoin Ordinals inscriptions, impacting all network users. While this surge in fees has sparked debates within the Bitcoin community, it seems these high costs might be a permanent fixture.

Data from Mempool.space indicates a substantial backlog of unconfirmed transactions in Bitcoin’s mempool. As a result, even transactions with a $2 fee are deprioritized, leaving almost 350,000 transactions pending confirmation.

This trend has significant implications for smaller investors, who may find regular on-chain transactions financially untenable. In response, many Bitcoin enthusiasts are advocating for layer-2 solutions like the Lightning Network. These solutions are designed to accommodate a larger user base, offering more affordable transaction options.

As the debate rages on, Bitcoin commentators emphasize the need to adapt to these changes. They suggest that the current high fees are just a preview of future scaling solutions, which will likely not occur on Bitcoin’s primary layer (Layer 1). Instead, these commentators argue for the adoption of layer-2 solutions, viewing them as essential for Bitcoin’s long-term scalability and usability.

Miners Reap Benefits Amid Fee Surge

Bitcoin miners are currently enjoying some of their best revenue periods in two years. This success is attributed to the combination of block subsidies and the high transaction fees. Interestingly, these earnings are comparable to the levels seen during Bitcoin’s peak price phase in November 2021.

Despite the challenges posed by high fees, Bitcoin continues to operate as originally designed. The network’s core philosophy is based on a competition-driven, proof-of-work model, which inherently involves higher fees over time. Critics of low fees point out that hard forks of Bitcoin intended to offer cheaper transactions have not significantly attracted value or users.

In this landscape, the Bitcoin community is encouraged to focus on developing and embracing layer-2 technologies. These advancements are not just about coping with high fees but are also seen as catalysts for innovation within the crypto ecosystem

Comments are closed.