MENA Crypto Surge: UAE Leads The Way

The MENA region, led by the UAE, is experiencing significant growth in its crypto economy due to proactive regulations.

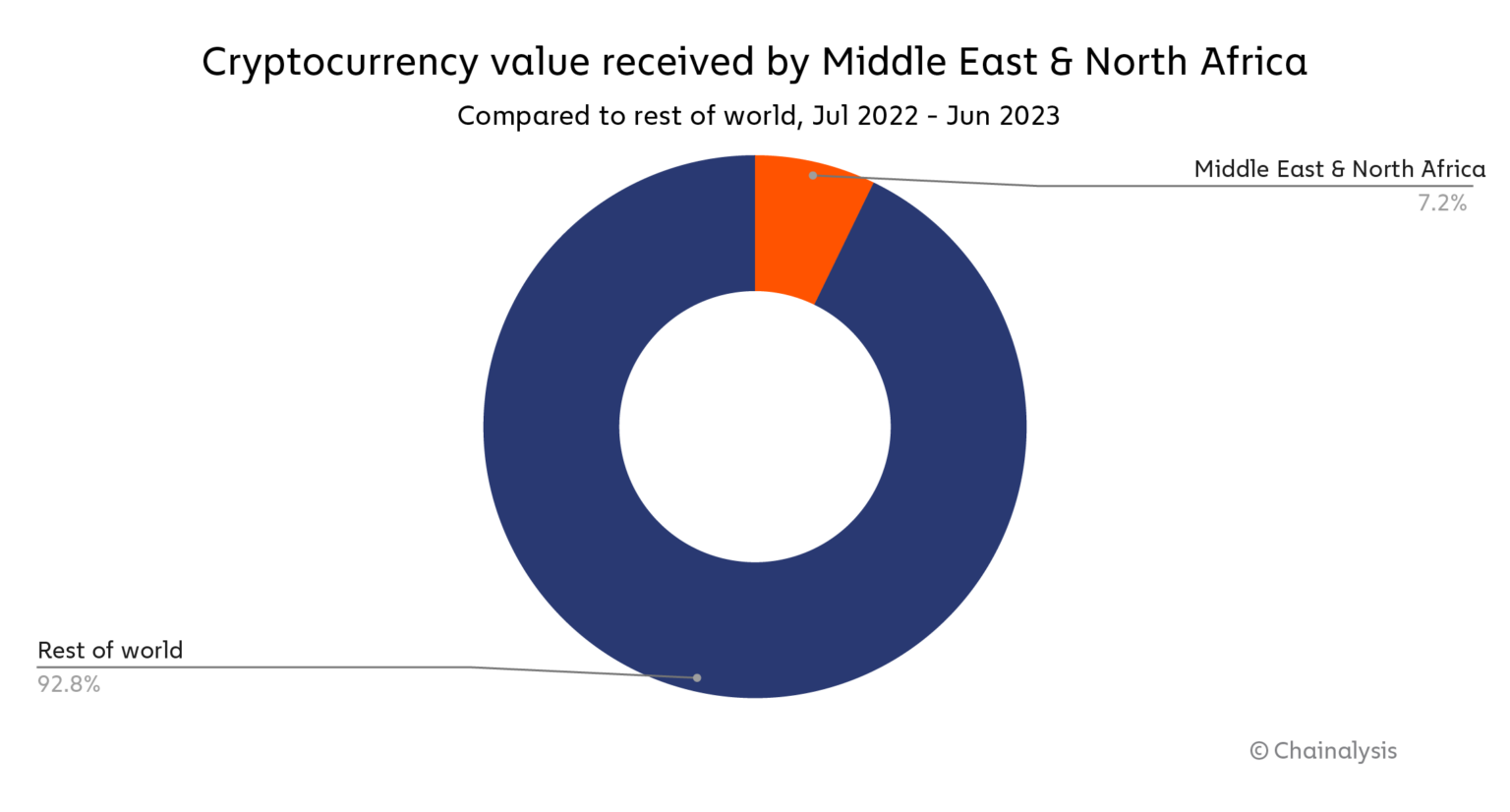

The crypto landscape has evolved immensely over the past year, with the Middle East & North Africa (MENA) region standing out as a major player. Between July 2022 and June 2023, MENA’s crypto economy saw an inflow of approximately $389.8 billion. This impressive growth accounts for nearly 7.2% of the worldwide crypto transaction volume. The spotlight, in this surge, shines brightly on the United Arab Emirates (UAE). The country’s proactive regulatory measures have propelled it to the forefront of crypto advancements in the region.

UAE: A Global Crypto Hub

The UAE’s commitment to fostering a conducive environment for cryptocurrency and blockchain has set it apart. Dubai, the bustling metropolis of the UAE, initiated its blockchain strategy back in 2016. By understanding the potential of this technology early on, the nation positioned itself at the vanguard of this digital revolution.

In 2018, the Abu Dhabi Global Market (ADGM) took a monumental step by introducing the world’s first regulatory framework tailored for cryptocurrency. This framework aimed to nurture crypto innovations while ensuring consumer safety. The primary objective was to establish the UAE as a digital economy leader.

Moreover, in 2022, Dubai took another stride by establishing the Virtual Asset Regulatory Authority (VARA). VARA’s mission aligns with ADGM’s, ensuring a uniform approach towards crypto regulation across the nation.

Attraction for Crypto Entrepreneurs

The UAE’s innovation-friendly stance towards cryptocurrency hasn’t just been beneficial on paper. The real-world implications are evident in the influx of crypto entrepreneurs and enthusiasts to the region. The clear and adaptive regulatory frameworks have been a magnet for crypto businesses, ensuring they can operate with clarity and confidence.

One shining example comes from Akos Erzse, Senior Manager for Public Policy at BitOasis, a renowned cryptocurrency trading platform based in Dubai. Erzse commends the UAE for its progressive regulatory landscape, highlighting VARA’s efforts in paving the way for crypto businesses. VARA’s specific rulebooks for various crypto services, like staking and advisory services, offer a clear roadmap for businesses. This distinct approach eliminates ambiguities and streamlines operations.

Competitive Edge in the Global Arena

As the global market shifts its focus to crypto hubs, the UAE’s forward-thinking regulatory approach offers it a distinctive advantage. The country’s ability to provide clear and responsive regulations makes it a prime destination for global crypto businesses and investors. The growing interest from high-net-worth individuals seeking to invest in virtual assets through regulated platforms further amplifies the UAE’s appeal.

Moreover, the UAE is poised to explore innovative crypto business models. The entry of platforms like TOKO, which specializes in asset tokenization, showcases the potential for further growth in the region.

Remittances stand out as a key area where crypto can make a substantial impact in the UAE. The UAE serves as a remittance hub, and the integration of cryptocurrency in this sector offers promising prospects. Given the increasing crypto adoption in countries like India, the Philippines, and Pakistan, which contribute significantly to the UAE’s expat population, there’s immense potential for growth.

Turkey’s Evolving Crypto Landscape

Outside of the UAE, Turkey emerges as a key player in the MENA region’s crypto scenario. With a crypto transaction volume of approximately $170 billion in the past year, Turkey has become a powerhouse. The nation’s young populace, keen on embracing innovative technologies, plays a significant role in this.

Recent economic challenges in Turkey, including rising inflation rates and the devaluation of the Turkish Lira, have pushed more people towards cryptocurrencies. As a protective measure against financial uncertainties, Turkish residents are increasingly viewing crypto as a safe haven.

Furthermore, the surge in interest towards Non-Fungible Tokens (NFTs) in Turkey, spearheaded by pioneers like Turkish-American entrepreneur Refik Anadol, emphasizes the nation’s hunger for crypto innovations.

Saudi Arabia: A Rising Crypto Star

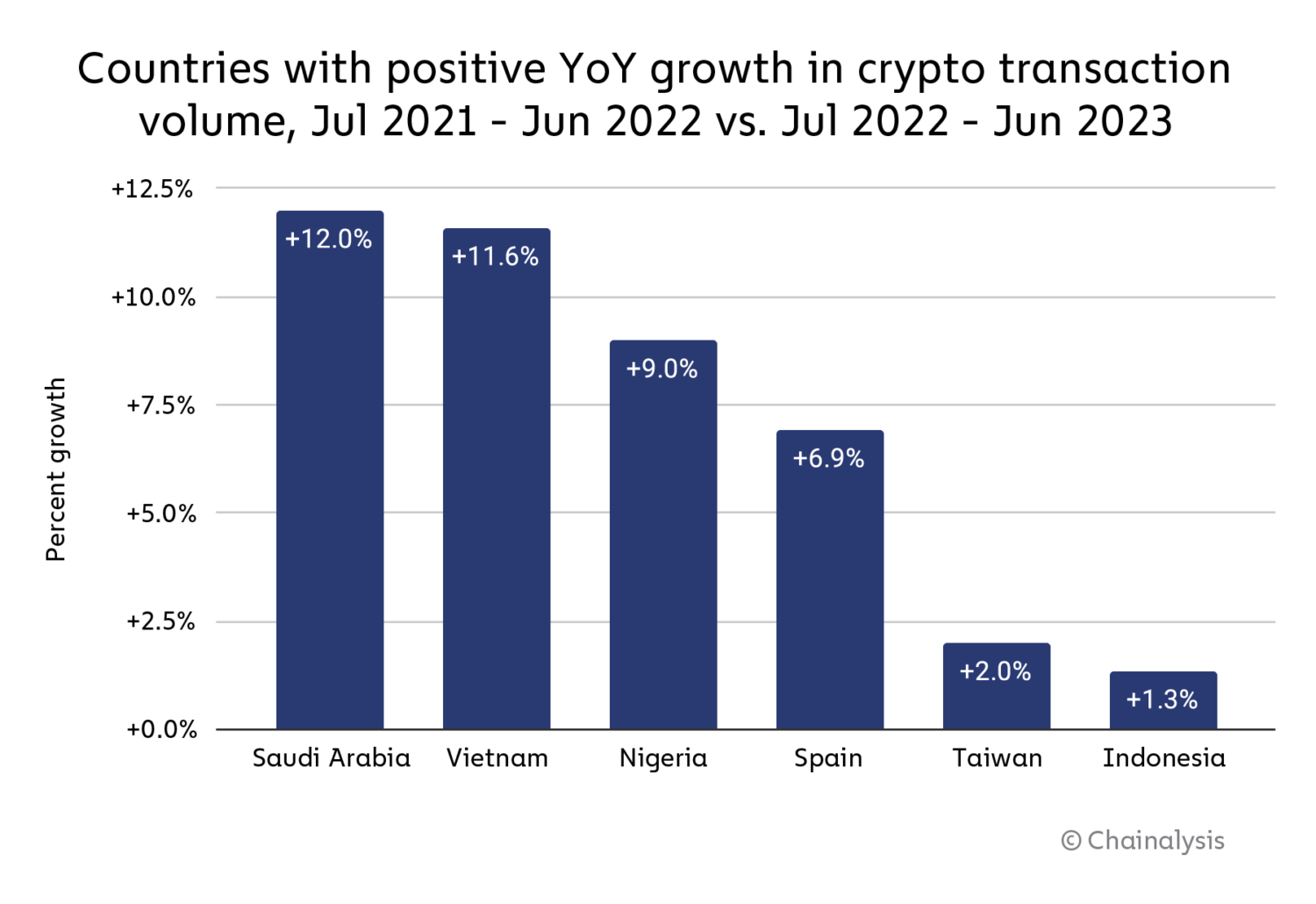

Another standout in the MENA region’s crypto growth story is Saudi Arabia. The nation recorded a year-over-year transaction volume growth of 12.0%. Abdulmajed Alhamzah, a key figure at the crypto exchange Rain, emphasizes the rising crypto adoption in the region, attributing it to the country’s diversifying investment landscape.

The MENA region, led by the visionary efforts of countries like the UAE, is carving out a niche for itself in the global crypto map. As regulations evolve and more nations recognize the potential of crypto, the future for MENA’s crypto economy looks incredibly promising.

Comments are closed.